It’s one reason why interoperability-the ability to pay anyone, at any time, to any account, regardless of the payment system used – is important to increasing the speed of payments, according to research by Glenbrook and the US Faster Payments Council. Or the lack thereof, can have a huge impact on cash flow for the receiving company. Here are some of the common challenges companies face: What are some common challenges businesses face in receiving cross-border payments?Ĭross-border payment processes can introduce additional costs, create cash flow challenges, and introduce inefficiencies because of limited access to payments data and insufficient transparency into payment flow.

#Invoices for business full#

Some 88% said the complexities of collecting cross-border payments impacts their ability to grow – with a full 40% saying it does so “significantly.” More than 90% of the 301 financial professionals surveyed in a recent Flywire research report indicated that their organization’s global expansion efforts could accelerate if they could find an easier way to deal with foreign exchange rates. It’s no wonder that companies eying global expansion cite managing international payments as a major obstacle.

How cost-effective the transaction is for both parties when considering currency exchange rates.

#Invoices for business how to#

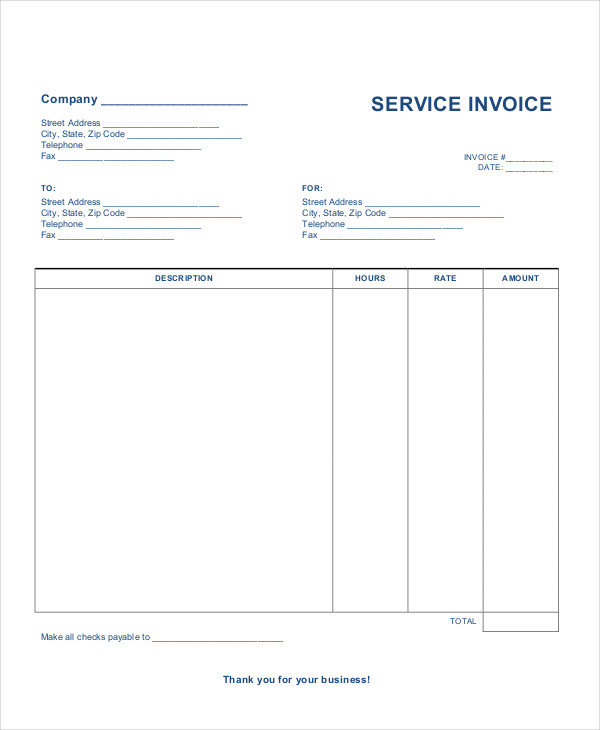

How to best avoid short pay (due to dynamic FX rates and hidden fees).How the business will receive payment in a timely and accurate manner.Assuring the correct documentation is sent by the payer for US tax purposes.Methods of payment (e.g., electronic, wire transfer) and what that means for compliance requirements.Regional, country-specific and local requirements, including invoice format, language, and more.When your business is invoicing an international customer, you must consider:

There are also the complexities of calculating payment itself, including FX rates, taxes and tariffs. Taking the international invoicing process alone, there are regional, country-specific and sometimes even local regulations and laws guiding what exactly the invoice must look like and how it must be delivered. What are some complexities with sending and receiving cross-border business payments?

0 kommentar(er)

0 kommentar(er)