Sign Up for the Revenued Business Card Todayįor complete details or to sign up, call +1 (877) 662-3489, or complete our online form, and a friendly financial expert will get back to you.We are an independent publisher.

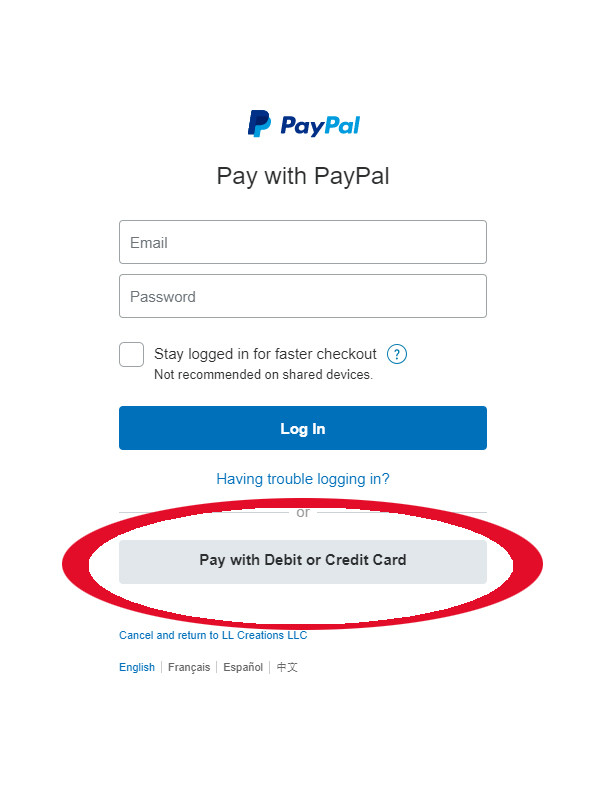

It’s important to understand those options so you can get the most out of your PayPal business account and debit card. With a PayPal Business Debit MasterCard, you do have options if you don’t have enough funds in your PayPal account for transactions you want to make. For example, if you know that you won’t have sufficient funds in your bank account, you may want to change the default backup funding source to a credit card in advance of the transaction. Keep in mind that you cannot change the backup funding source once a transaction has been made. That means you would be limited to transactions that are within your PayPal account balance, without the option of using a linked bank account or credit card. However, if the transaction does bounce, PayPal may no longer allow debit card transactions to go through if you have insufficient funds in your PayPal account in the future. PayPal will try your bank account one more time if the transaction bounces the first time. For instance, if you have insufficient funds in both your PayPal account and your backup bank account, the transaction will bounce back to your PayPal account, and you may also be charged an insufficient funds fee by your bank. You can run into trouble if you don’t have sufficient funds in your backup funding source. If you don’t have enough funds in your PayPal account for a transaction, the purchase will instead come out of your backup bank account or be charged to your credit card. Backup funding sources can include your confirmed bank account, PayPal Smart Connect account, the PayPal Extras MasterCard or the PayPal Cashback MasterCard. If you have insufficient funds in your PayPal account, your debit card purchases may be declined - unless you designate a backup payment source for your card. Can You Overdraw a PayPal Business Debit Card?

Cash back rewards are calculated at the end of every month and added to your PayPal balance. The PayPal Business Debit MasterCard also offers 1 percent cash back on eligible purchases, which must be credit transactions rather than debit transactions. You can also use your PayPal debit card to withdraw cash from your PayPal business account at an ATM, or use your card as a debit card to make purchases and get cash back (limit of $400 per day). There is a $3,000 daily limit on purchases. This allows you to spend funds that are in your PayPal business account without being required to transfer them to your bank account first.Īs with many debit cards, you can choose to designate your PayPal Business Debit MasterCard transactions as either debit or credit - either way, purchases will be drawn from your PayPal account. This card works like a debit card, but instead of drawing from your bank account, it draws from your PayPal account. One feature that PayPal offers business account holders is the PayPal Business Debit MasterCard. PayPal also offers businesses a variety of other features and services to choose from depending on their needs.īoth personal and business users can make purchases with their PayPal account even if they don’t have any funds in the account, because the payment amount can be charged to a linked bank account or credit card. Businesses must pay fees when they receive payments for purchases via PayPal.

PAYPAL DEBIT CARD FREE

Personal transfers between friends and family are free of charge.īusiness accounts allow companies to receive and send payments for purchases either through in-person transactions or online. Personal accounts are designed for users who want to transfer money for personal uses, such as buying items online or transferring money to friends. PayPal offers both personal and business accounts. You can also link your PayPal account to credit or debit cards, which can be used to make purchases. Your PayPal account can be linked to a bank account, and funds from your PayPal account can be transferred to your bank account (and vice versa). Payments or transfers are deposited into your PayPal account. In order to use PayPal for customer payments, you must set up a PayPal account and enable PayPal payments on your website, mobile card reader or point-of-sale system. PayPal was one of the first providers to facilitate safe and easy online payments, and it’s still a major provider of payment services to businesses. It’s important to know exactly how this card works - including overdraft features - to determine if it’s a good choice for your business and to use it correctly. The PayPal Business Debit MasterCard can be a convenient way for businesses that use PayPal to access the funds in their PayPal account. Does the PayPal Business Debit Card Offer Overdraft?

0 kommentar(er)

0 kommentar(er)